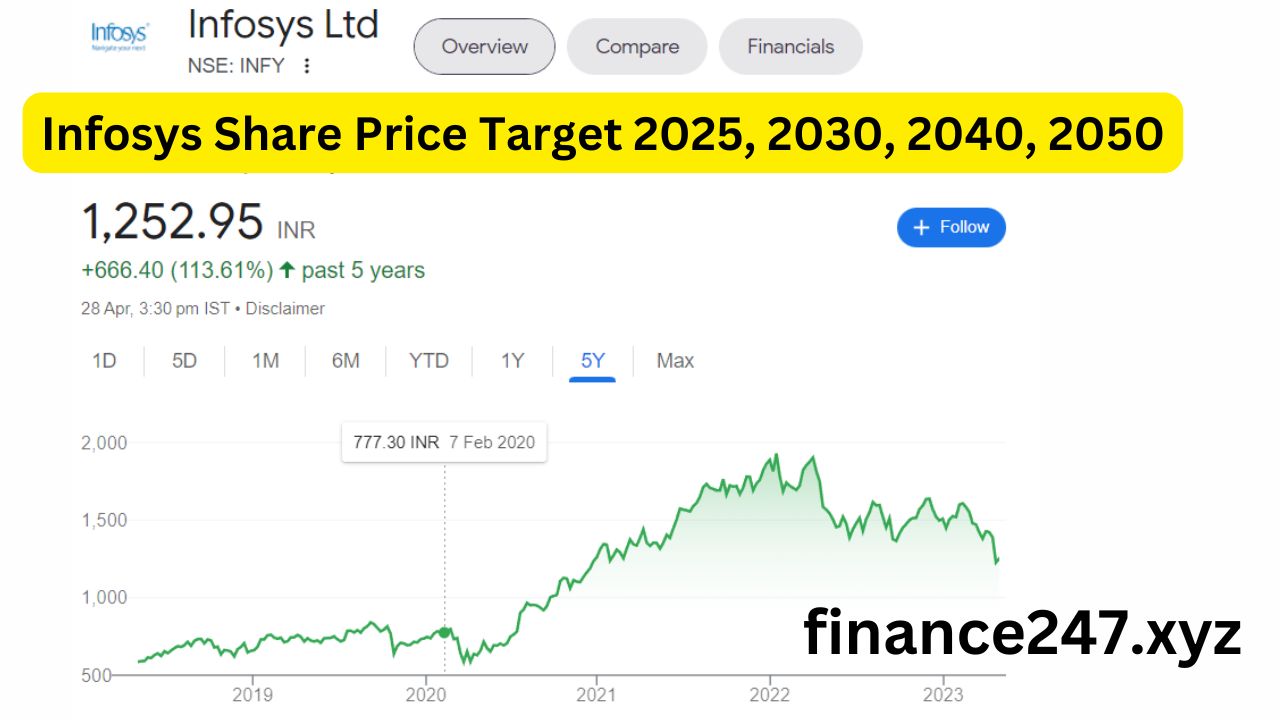

Infosys, a stalwart in the global IT services industry, has been a beacon of innovation and growth since its inception. As we look toward the future, investors and analysts alike are keen to project the company’s share price trajectory for the years 2025, 2030, 2040, and 2050.

While forecasting such long-term targets involves a degree of speculation, we can draw insights from current trends, strategic initiatives, and market analyses to envision potential scenarios.

Infosys Share Price Target for 2025

By 2025, Infosys is expected to continue its robust growth trajectory, driven by its emphasis on digital transformation, artificial intelligence (AI), and cloud computing services. The company’s strategic partnerships and expanding global footprint are likely to bolster its market position.

Various analyses suggest that Infosys’ share price could range between ₹1,830 and ₹2,450 by 2025. This projection considers the company’s consistent revenue growth and its ability to adapt to evolving technological landscapes.

Infosys Share Price Target for 2030

Looking ahead to 2030, Infosys is anticipated to further solidify its leadership in the IT sector. With continuous investments in research and development, particularly in AI, machine learning, and cybersecurity, the company is well-positioned to capitalize on emerging opportunities.

Analysts project that Infosys’ share price could reach between ₹3,510 and ₹4,100 by 2030, reflecting its sustained commitment to innovation and market expansion.

Infosys Share Price Target for 2040

By 2040, Infosys is expected to be a major player in digital transformation on a global scale. Technological advancements such as AI, quantum computing, and blockchain will redefine industries, and Infosys’ ability to adapt to these changes will be key to its success.

Projections indicate that the company’s share price could range between ₹6,900 and ₹7,800 by 2040, underscoring its long-term growth strategy and capacity for innovation.

Infosys Share Price Target for 2050

Looking even further ahead to 2050, Infosys is expected to reach new heights, with a share price target ranging from ₹12,500 to ₹14,500. The company’s global expansion and leadership in emerging technologies will drive this growth.

Factors Influencing Infosys’ Future Share Price

Several key factors are poised to influence Infosys’ share price over the coming decades:

- Technological Advancements: Infosys’ proactive approach to adopting and integrating cutting-edge technologies such as AI, machine learning, and blockchain will play a pivotal role in its growth. By staying at the forefront of technological innovation, the company can offer advanced solutions that meet evolving client needs.

- Global Expansion: Infosys’ strategic expansion into emerging markets and strengthening its presence in established ones will contribute significantly to its revenue streams. By diversifying its market reach, the company can mitigate risks associated with regional economic fluctuations.

- Strategic Partnerships and Acquisitions: Forming alliances with other industry leaders and acquiring companies with complementary capabilities can enhance Infosys’ service offerings and market share. Such collaborations can lead to synergies that drive growth and innovation.

- Focus on Sustainability: As global emphasis on sustainability intensifies, Infosys’ commitment to environmentally friendly practices and solutions can enhance its brand reputation and attract clients prioritizing corporate social responsibility.

- Talent Acquisition and Retention: Maintaining a skilled and motivated workforce is crucial for Infosys’ continued success. Investing in employee development and fostering an inclusive work culture can lead to higher productivity and innovation.

Challenges and Considerations

While the outlook for Infosys appears promising, it is essential to acknowledge potential challenges that could impact its share price:

- Market Competition: The IT services industry is highly competitive, with numerous players vying for market share. Infosys must continuously innovate and differentiate its offerings to maintain its competitive edge.

- Economic Fluctuations: Global economic uncertainties, such as recessions or geopolitical tensions, can affect client spending on IT services, potentially impacting Infosys’ revenues.

- Regulatory Changes: Evolving regulations in different countries can pose compliance challenges for Infosys, necessitating agile adaptation to maintain operations across diverse markets.

- Technological Disruptions: Rapid technological changes can render existing services obsolete. Infosys must stay ahead of technological trends to offer relevant and up-to-date solutions.

Conclusion

Infosys’ strategic focus on technological innovation, global expansion, and sustainable practices positions it well for continued growth in the coming decades.

While projections indicate a positive trajectory for its share price, investors should remain cognizant of the dynamic nature of the global economy and the IT services industry. Continuous evaluation of market conditions, coupled with Infosys’ strategic initiatives, will be crucial in realizing these projected share price targets.

Also Read: Gold and Silver Prices Today (March 11, 2025): Latest Rates and Market Insights